Using intelligence to navigate the waters of sub $30 oil

- Jeff Jacobsen

- May 3, 2020

- 3 min read

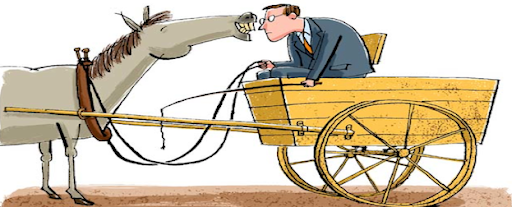

As John Lennon and Paul McCartney so famously asked, “Picture yourself in a boat on a river”. If you’re in the upstream sector of oil and gas, now picture that boat is your company, and the river is the conduit between success and failure. The curves and bends of the river are defined by the day-to-day obstacles companies face in our industry. The navigation of the boat is left up to your employees, diligently following the strategy set from the executives. Think of the information systems in your company as the propulsion and navigation systems, giving you the necessary information to reach your journey’s end successfully. And lastly, consider the price of our precious commodity, as it is dictated by forces out of our control, being the forces of nature that act upon the river. It is the reaction to these commodity price swings that often reveal the true nature of a company operating in the upstream sector of the oil and gas industry.

Let’s go back to that good ole stretch between mid 2010 and mid 2014 when the average oil price was comfortably over $100/barrel. Buoyed by the high price of oil and the riches that followed, most upstream operators violated the first rule of the Theory of Business – they stopped examining themselves, became comfortable, and some actually thought their outstanding performance was based solely on their own efforts. When in fact, it was $100 barrel oil that provided a strong current, allowing their companies to easily navigate all the hazards that lurked well below the water. Most companies scaled back on their propulsion systems (Information Technology), as they didn’t see a need for advancing their IT efforts in such a boom market.

There is another axiom in business that states “the good news is that nothing last forever, and the bad news is that nothing lasts forever”. With the latter hitting the upstream operators square in the face in the 2nd quarter of 2014, it was time to separate the wheat from the chaff. From the rubble came two distinct upstream operators – 1) the prepared, and 2) the walking dead.

It was not very difficult to spot the struggling companies – as the sub $30 oil price slowed down the current in the river, these huge barges (companies) were force to navigate the treacherous waters on their own. They immediately switched on the navigation and propulsion systems only to find out that they offered no help at all. In fact, using their very own information systems was akin to navigating the boat using the rear view mirror, with very little chances of avoiding all the hazards that now appeared due to the low oil price. The symptoms of these problems should have been evident from the outset of the business. Most of the upstream operators who suffered during these “drought” conditions displayed one overwhelming weakness vis-à-vis their strategy (or lack thereof) toward information and intelligence gathering within their companies. The biggest failing was the reliance on the accounting/finance systems as their main source of information, coupled with the fact that these systems were configured and implemented by the accounting and financial personnel. The executives failed to recognize that the very nature of accounting is to look at information from an historical perspective, usually several months in arrears – hence, the rear view mirror. The executives also failed to realize that accountants, when given the chance, configure their systems to make their work processes flow better – it’s human nature. However, this does not help from an operational perspective in times of dire need.

In closing, it almost goes without saying, that the most successful companies took a totally different approach when times were good. The successful companies were characterized by three simple principles:

· Information and Intelligence are treated as an Asset.

· Corporate information strategy is driven from the C-Level.

· All information systems are configured to support Operations.

Seems pretty simple, doesn’t it. However, if your company is currently struggling to navigate the current waters that are the upstream oil and gas sector, please reach out to the experts at Blue Ocean Existence (www.BlueOceanExistence.com)

コメント